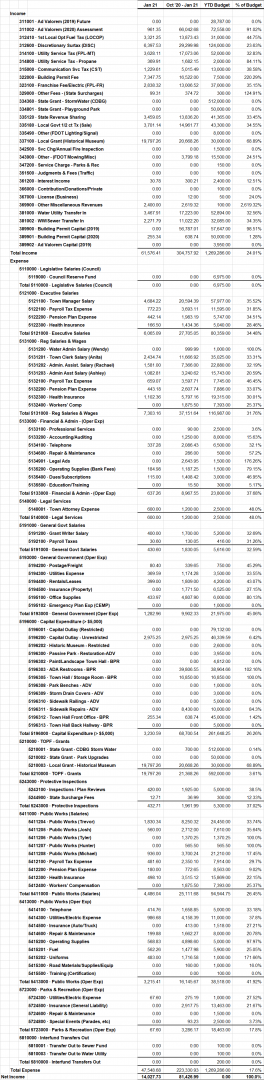

| Jan 21 | Oct ’20 – Jan 21 | YTD Budget | % of Budget | ||||

| Income | |||||||

| 311001 · Ad Valorem (2019) Future | 0.00 | 0.00 | 28,787.00 | 0.0% | |||

| 311002 · Ad Valorem (2020) Assessment | 961.35 | 66,042.68 | 72,558.00 | 91.02% | |||

| 312410 · 1st Local Opt Fuel Tax (LOCOP) | 3,321.25 | 13,873.43 | 31,000.00 | 44.75% | |||

| 312600 · Discretionary Surtax (DISC) | 6,397.53 | 29,299.98 | 124,000.00 | 23.63% | |||

| 314100 · Utility Service Tax (FPL-MT) | 3,628.11 | 17,073.06 | 52,000.00 | 32.83% | |||

| 314800 · Utility Service Tax – Propane | 369.91 | 1,682.15 | 2,000.00 | 84.11% | |||

| 315000 · Communication Svc Tax (CST) | 1,229.61 | 5,015.49 | 13,000.00 | 38.58% | |||

| 322000 · Building Permit Fee | 7,347.75 | 16,522.00 | 7,500.00 | 220.29% | |||

| 323100 · Franchise Fee/Electric (FPL-FR) | 2,838.32 | 13,006.52 | 37,000.00 | 35.15% | |||

| 329000 · Other Fees – (State Surcharges) | 99.31 | 374.72 | 300.00 | 124.91% | |||

| 334360 · State Grant – StormWater (CDBG) | 0.00 | 0.00 | 512,000.00 | 0.0% | |||

| 334801 · State Grant – Playground Park | 0.00 | 0.00 | 50,000.00 | 0.0% | |||

| 335120 · State Revenue Sharing | 3,459.05 | 13,836.20 | 41,365.00 | 33.45% | |||

| 335180 · Local Govt 1/2 ct Tx (Sale) | 3,701.14 | 14,961.77 | 43,300.00 | 34.55% | |||

| 335490 · Other (FDOT Lighting/Signal) | 0.00 | 0.00 | 8,000.00 | 0.0% | |||

| 337100 · Local Grant (Historical Museum) | 19,797.26 | 20,668.26 | 30,000.00 | 68.89% | |||

| 342500 · Svc Chg/Annual Fire Inspection | 0.00 | 0.00 | 1,500.00 | 0.0% | |||

| 343900 · Other – (FDOT Mowing/Misc) | 0.00 | 3,799.18 | 15,500.00 | 24.51% | |||

| 347200 · Service Charge – Parks & Rec | 0.00 | 0.00 | 150.00 | 0.0% | |||

| 351500 · Judgments & Fees (Traffic) | 0.00 | 0.00 | 100.00 | 0.0% | |||

| 361200 · Interest Income | 30.78 | 300.21 | 2,400.00 | 12.51% | |||

| 366000 · Contribution/Donations/Private | 0.00 | 0.00 | 100.00 | 0.0% | |||

| 367000 · License (Business) | 0.00 | 12.00 | 50.00 | 24.0% | |||

| 369900 · Other Miscellaneous Revenues | 2,400.00 | 2,619.32 | 100.00 | 2,619.32% | |||

| 381000 · Water Utility Transfer In | 3,467.91 | 17,223.00 | 52,894.00 | 32.56% | |||

| 381002 · WW/Sewer Transfer In | 2,271.79 | 11,022.20 | 32,085.00 | 34.35% | |||

| 389900 · Building Permit Capital (2019) | 0.00 | 56,787.01 | 57,647.00 | 98.51% | |||

| 389901 · Building Permit Capital (2020) | 255.34 | 638.74 | 50,000.00 | 1.28% | |||

| 389902 · Ad Valorem Capital (2019) | 0.00 | 0.00 | 3,950.00 | 0.0% | |||

| Total Income | 61,576.41 | 304,757.92 | 1,269,286.00 | 24.01% | |||

| Expense | |||||||

| 5110000 · Legislative Salaries (Council) | |||||||

| 5119000 · Council Reserve Fund | 0.00 | 0.00 | 6,975.00 | 0.0% | |||

| Total 5110000 · Legislative Salaries (Council) | 0.00 | 0.00 | 6,975.00 | 0.0% | |||

| 5121000 · Executive Salaries | |||||||

| 5121100 · Town Manager Salary | 4,684.22 | 20,594.39 | 57,977.00 | 35.52% | |||

| 5122100 · Payroll Tax Expense | 772.23 | 3,693.11 | 11,595.00 | 31.85% | |||

| 5122200 · Pension Plan Expense | 442.14 | 1,983.19 | 5,747.00 | 34.51% | |||

| 5122300 · Health Insurance | 166.50 | 1,434.36 | 5,040.00 | 28.46% | |||

| Total 5121000 · Executive Salaries | 6,065.09 | 27,705.05 | 80,359.00 | 34.48% | |||

| 5131000 · Reg Salaries & Wages | |||||||

| 5131200 · Water Admin Salary (Wendy) | 0.00 | 999.99 | 1,000.00 | 100.0% | |||

| 5131201 · Town Clerk Salary (Anita) | 2,434.74 | 11,666.92 | 35,025.00 | 33.31% | |||

| 5131202 · Admin. Assist. Salary (Rachael) | 1,581.00 | 7,366.00 | 22,880.00 | 32.19% | |||

| 5131203 · Admin Asst Salary (Ashley) | 1,082.81 | 3,240.62 | 15,743.00 | 20.59% | |||

| 5132100 · Payroll Tax Expense | 659.07 | 3,597.71 | 7,745.00 | 46.45% | |||

| 5132200 · Pension Plan Expense | 443.18 | 2,607.74 | 7,886.00 | 33.07% | |||

| 5132300 · Health Insurance | 1,102.36 | 5,797.16 | 19,315.00 | 30.01% | |||

| 5132400 · Workers’ Comp | 0.00 | 1,875.50 | 7,393.00 | 25.37% | |||

| Total 5131000 · Reg Salaries & Wages | 7,303.16 | 37,151.64 | 116,987.00 | 31.76% | |||

| 5133000 · Financial & Admin – (Oper Exp) | |||||||

| 5133100 · Professional Services | 0.00 | 90.00 | 2,500.00 | 3.6% | |||

| 5133200 · Accounting/Auditing | 0.00 | 1,250.00 | 8,000.00 | 15.63% | |||

| 5134100 · Telephone | 337.28 | 2,086.43 | 6,500.00 | 32.1% | |||

| 5134600 · Repair & Maintenance | 0.00 | 286.00 | 500.00 | 57.2% | |||

| 5134901 · Legal Ads | 0.00 | 2,643.95 | 1,500.00 | 176.26% | |||

| 5135200 · Operating Supplies (Bank Fees) | 184.98 | 1,187.25 | 1,500.00 | 79.15% | |||

| 5135400 · Dues/Subscriptions | 115.00 | 1,408.42 | 3,000.00 | 46.95% | |||

| 5135500 · Education/Training | 0.00 | 15.50 | 300.00 | 5.17% | |||

| Total 5133000 · Financial & Admin – (Oper Exp) | 637.26 | 8,967.55 | 23,800.00 | 37.68% | |||

| 5140000 · Legal Services | |||||||

| 5140001 · Town Attorney Expense | 600.00 | 1,200.00 | 2,500.00 | 48.0% | |||

| Total 5140000 · Legal Services | 600.00 | 1,200.00 | 2,500.00 | 48.0% | |||

| 5191000 · General Govt Salaries | |||||||

| 5191200 · Grant Writer Salary | 400.00 | 1,700.00 | 5,200.00 | 32.69% | |||

| 5192100 · Payroll Taxes | 30.60 | 130.05 | 416.00 | 31.26% | |||

| Total 5191000 · General Govt Salaries | 430.60 | 1,830.05 | 5,616.00 | 32.59% | |||

| 5193000 · General Government (Oper Exp) | |||||||

| 5194200 · Postage/Freight | 80.40 | 339.65 | 750.00 | 45.29% | |||

| 5194300 · Utilities Expense | 369.59 | 1,174.28 | 3,500.00 | 33.55% | |||

| 5194400 · Rentals/Leases | 399.00 | 1,809.00 | 4,200.00 | 43.07% | |||

| 5194500 · Insurance (Property) | 0.00 | 1,771.50 | 6,525.00 | 27.15% | |||

| 5195100 · Office Supplies | 433.97 | 4,807.90 | 6,000.00 | 80.13% | |||

| 5195102 · Emergency Plan Exp (CEMP) | 0.00 | 0.00 | 1,000.00 | 0.0% | |||

| Total 5193000 · General Government (Oper Exp) | 1,282.96 | 9,902.33 | 21,975.00 | 45.06% | |||

| 5196000 · Capital Expenditure (> $5,000) | |||||||

| 5196001 · Capital Outlay (Restricted) | 0.00 | 0.00 | 79,132.00 | 0.0% | |||

| 5196200 · Capital Outlay – Unrestricted | 2,975.25 | 2,975.25 | 46,339.59 | 6.42% | |||

| 5196202 · Historic Museum – Restricted | 0.00 | 0.00 | 2,600.00 | 0.0% | |||

| 5196300 · Passive Park – Restoration-ADV | 0.00 | 0.00 | 3,950.00 | 0.0% | |||

| 5196302 · Paint/Landscape Town Hall – BPR | 0.00 | 0.00 | 4,812.00 | 0.0% | |||

| 5196303 · ADA Restrooms – BPR | 0.00 | 39,806.55 | 38,964.66 | 102.16% | |||

| 5196305 · Town Hall / Storage Room – BPR | 0.00 | 16,850.00 | 16,850.00 | 100.0% | |||

| 5196308 · Park Benches – ADV | 0.00 | 0.00 | 1,000.00 | 0.0% | |||

| 5196309 · Storm Drain Covers – ADV | 0.00 | 0.00 | 3,000.00 | 0.0% | |||

| 5196310 · Sidewalk Railings – ADV | 0.00 | 0.00 | 5,000.00 | 0.0% | |||

| 5196311 · Sidewalk Repairs – ADV | 0.00 | 8,430.00 | 10,000.00 | 84.3% | |||

| 5196312 · Town Hall Front Office – BPR | 255.34 | 638.74 | 45,000.00 | 1.42% | |||

| 5196313 · Town Hall Back Hallway – BPR | 0.00 | 0.00 | 5,000.00 | 0.0% | |||

| Total 5196000 · Capital Expenditure (> $5,000) | 3,230.59 | 68,700.54 | 261,648.25 | 26.26% | |||

| 5210000 · TOPF – Grants | |||||||

| 5210001 · State Grant – CDBG Storm Water | 0.00 | 700.00 | 512,000.00 | 0.14% | |||

| 5210002 · State Grant – Park Upgrades | 0.00 | 0.00 | 50,000.00 | 0.0% | |||

| 5210003 · Local Grant – Historical Museum | 19,797.26 | 20,668.26 | 30,000.00 | 68.89% | |||

| Total 5210000 · TOPF – Grants | 19,797.26 | 21,368.26 | 592,000.00 | 3.61% | |||

| 5243000 · Protective Inspections | |||||||

| 5243100 · Inspections / Plan Reviews | 420.00 | 1,925.00 | 5,000.00 | 38.5% | |||

| 5244900 · State Surcharge Fees | 12.71 | 36.99 | 300.00 | 12.33% | |||

| Total 5243000 · Protective Inspections | 432.71 | 1,961.99 | 5,300.00 | 37.02% | |||

| 5411000 · Public Works (Salaries) | |||||||

| 5411204 · Public Works (Trevor) | 1,830.34 | 8,250.32 | 24,450.00 | 33.74% | |||

| 5411205 · Public Works (Josh) | 560.00 | 2,712.00 | 7,610.00 | 35.64% | |||

| 5411206 · Public Works (Tyler) | 0.00 | 1,370.25 | 1,370.25 | 100.0% | |||

| 5411207 · Public Works (Hunter) | 0.00 | 565.50 | 565.50 | 100.0% | |||

| 5411208 · Public Works (Michael) | 936.00 | 3,700.24 | 21,210.00 | 17.45% | |||

| 5412100 · Payroll Tax Expense | 481.60 | 2,350.10 | 7,914.00 | 29.7% | |||

| 5412200 · Pension Plan Expense | 180.00 | 772.65 | 8,563.00 | 9.02% | |||

| 5412300 · Health Insurance | 498.10 | 3,515.12 | 15,869.00 | 22.15% | |||

| 5412400 · Workers’ Compensation | 0.00 | 1,875.50 | 7,393.00 | 25.37% | |||

| Total 5411000 · Public Works (Salaries) | 4,486.04 | 25,111.68 | 94,944.75 | 26.45% | |||

| 5413000 · Public Works (Oper Exp) | |||||||

| 5414100 · Telephone | 414.76 | 1,658.85 | 5,000.00 | 33.18% | |||

| 5414300 · Utilities/Electric Expense | 986.68 | 4,158.39 | 11,000.00 | 37.8% | |||

| 5414500 · Insurance (Auto/Truck) | 0.00 | 413.00 | 1,518.00 | 27.21% | |||

| 5414600 · Repair & Maintenance | 199.88 | 1,662.27 | 8,000.00 | 20.78% | |||

| 5415200 · Operating Supplies | 568.83 | 4,898.60 | 5,000.00 | 97.97% | |||

| 5415201 · Fuel | 562.26 | 1,477.98 | 5,900.00 | 25.05% | |||

| 5415202 · Uniforms | 483.00 | 1,716.58 | 1,000.00 | 171.66% | |||

| 5415300 · Road Materials/Supplies/Equip | 0.00 | 160.00 | 1,000.00 | 16.0% | |||

| 5415500 · Training (Certification) | 0.00 | 0.00 | 100.00 | 0.0% | |||

| Total 5413000 · Public Works (Oper Exp) | 3,215.41 | 16,145.67 | 38,518.00 | 41.92% | |||

| 5723000 · Parks & Recreation (Oper Exp) | |||||||

| 5724300 · Utilities/Electric Expense | 67.60 | 275.19 | 1,000.00 | 27.52% | |||

| 5724500 · Insurance (General Liability) | 0.00 | 2,917.75 | 13,463.00 | 21.67% | |||

| 5724600 · Repair & Maintenance | 0.00 | 0.00 | 1,500.00 | 0.0% | |||

| 5724800 · Special Events (Parades, etc) | 0.00 | 93.23 | 2,500.00 | 3.73% | |||

| Total 5723000 · Parks & Recreation (Oper Exp) | 67.60 | 3,286.17 | 18,463.00 | 17.8% | |||

| 5810000 · Interfund Transfers Out | |||||||

| 5810001 · Transfer Out to Sewer Fund | 0.00 | 0.00 | 100.00 | 0.0% | |||

| 5810003 · Transfer Out to Water Utility | 0.00 | 0.00 | 100.00 | 0.0% | |||

| Total 5810000 · Interfund Transfers Out | 0.00 | 0.00 | 200.00 | 0.0% | |||

| Total Expense | 47,548.68 | 223,330.93 | 1,269,286.00 | 17.6% | |||

| Net Income | 14,027.73 | 81,426.99 | 0.00 | 100.0%

|

|||